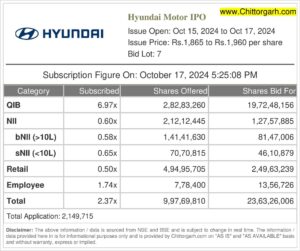

October 17, 2024 Hyundai Motor’s initial public offering (IPO) witnessed significant interest from investors, closing with an overall subscription of 2.37 times its offer size on October 17, 2024. The IPO, which was open for three days, priced shares between ₹1,865 and ₹1,960, with a bid lot of 7 shares.

Key Subscription Figures:

Qualified Institutional Buyers (QIBs): The QIB portion was the most active, oversubscribed by a robust 6.97 times. This category saw bids for 19.72 crore shares against the 2.82 crore shares on offer.

Non-Institutional Investors (NIIs): Subscriptions in this category were more subdued. The NII segment was subscribed 0.60 times. Within this, high-net-worth investors bidding for shares worth over ₹10 lakh (bNII) subscribed 0.58 times, while smaller investors (sNII) subscribed 0.65 times.

Retail Investors: The retail portion saw a subscription of 0.50 times, indicating some lukewarm interest with 2.49 crore shares bid against 4.94 crore shares offered.

Employee Category: Hyundai Motor’s employees showed strong confidence, with the employee quota subscribed 1.74 times.

The IPO received a total of 21.49 lakh applications, underscoring the significant interest, particularly from institutional buyers, despite more reserved demand from retail and non-institutional investors.

Investors will now eagerly await the allotment process as Hyundai Motor prepares to make its debut on the stock exchanges.

Your article helped me a lot, is there any more related content? Thanks!