Hyundai Motor’s highly anticipated Initial Public Offering (IPO) opened on October 15, 2024, and is scheduled to close on October 17, 2024. Priced between ₹1,865 and ₹1,960 per share, with a minimum bid lot of 7 shares, the IPO has been garnering significant attention across various investor categories.

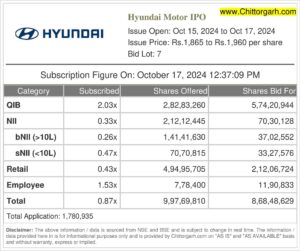

As of 12:37 PM on October 17, the subscription data reveals mixed interest across categories:

Qualified Institutional Buyers (QIB) have shown strong interest with a subscription of 2.03x, with 5,74,20,944 shares bid against 2,82,83,260 shares offered.

Non-Institutional Investors (NII), categorized into small and big investors, have subscribed at relatively lower levels:

Large NII (bNII) with investments above ₹10 lakhs have subscribed at 0.26x, with 37,02,552 shares bid against 1,41,41,630 shares offered.

Small NII (sNII), investing less than ₹10 lakhs, have subscribed at 0.47x, bidding for 33,27,576 shares against 70,70,815 shares offered.

The Retail Individual Investors (RII) category has seen a modest subscription of 0.43x, with 2,12,06,724 shares bid for 4,94,95,705 shares offered.

Employees of Hyundai have subscribed 1.53x, bidding for 11,90,833 shares against 7,78,400 shares offered.

In total, the IPO has been subscribed 0.87x, with 8,68,48,629 shares bid for 9,97,69,810 shares offered, attracting 1,780,935 total applications.

The response from institutional investors has been encouraging, while retail and non-institutional categories are showing moderate demand. As the final hours approach, market watchers are keenly observing how the remaining bids will shape up, potentially influencing the overall subscription numbers before the IPO close

This IPO offers an important investment opportunity for both retail and institutional investors, and the final outcome will be closely monitored as the subscription period comes to an end today.